Hybrid Line of Credit: Innovative Financial Products from Wyoming Credit Unions

Hybrid Line of Credit: Innovative Financial Products from Wyoming Credit Unions

Blog Article

The Ultimate Guide to Comprehending Credit Scores Unions

Lending institution stand as special financial entities, rooted in concepts of mutual assistance and member-driven procedures. Beyond their foundational worths, understanding the detailed workings of credit rating unions involves a much deeper expedition. Unwinding the intricacies of membership qualification, the development of solutions offered, and the unique benefits they bring requires a thorough examination. As we navigate via the ins and outs of lending institution, an informative trip waits for to clarify these member-focused organizations and how they vary from conventional banks.

What Are Credit History Unions?

Credit scores unions are member-owned monetary organizations that use an array of banking solutions to their participants. Unlike standard banks, cooperative credit union operate as not-for-profit organizations, implying their primary emphasis gets on offering their participants instead than making best use of earnings. Members of a cooperative credit union usually share a typical bond, such as working for the very same company, belonging to the exact same neighborhood, or becoming part of the very same organization.

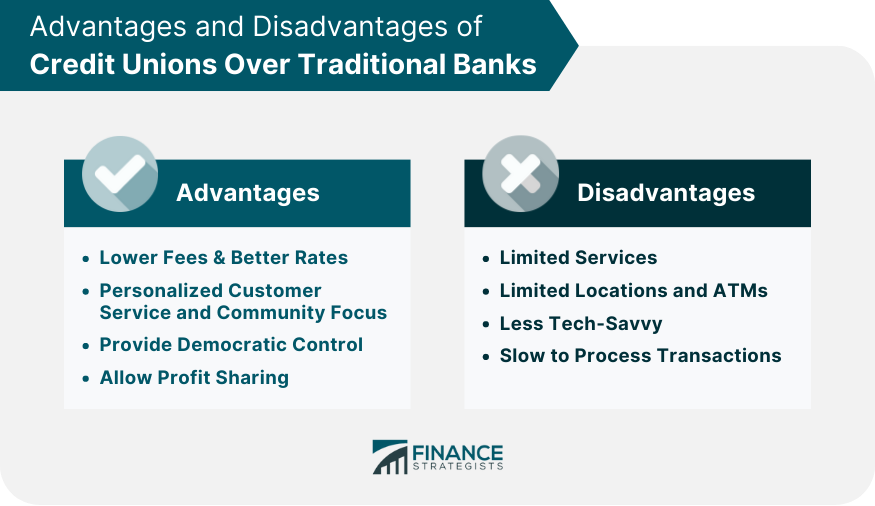

One of the vital benefits of credit scores unions is that they usually supply higher rates of interest on interest-bearing accounts and lower rates of interest on financings compared to banks. Credit Union in Wyoming. This is because cooperative credit union are structured to benefit their participants straight, permitting them to hand down their earnings in the kind of better rates and fewer fees. Additionally, lending institution are understood for their individualized customer care, as they focus on constructing connections with their participants to comprehend their special economic requirements and objectives

History and Development of Cooperative Credit Union

The origins of member-owned monetary cooperatives, known today as cooperative credit union, trace back to a time when areas sought options to typical banking institutions. The idea of lending institution come from the 19th century in Europe, with Friedrich Wilhelm Raiffeisen typically credited as the pioneer of the cooperative financial activity. Raiffeisen founded the very first recognized lending institution in Germany in the mid-1800s, highlighting community assistance and self-help concepts.

The development of debt unions continued in The United States and copyright, where Alphonse Desjardins established the first credit rating union in copyright in 1900. Soon after, in 1909, the first U.S. cooperative credit union was created in New Hampshire by a team of Franco-American immigrants. These very early lending institution operated the basic concepts of mutual assistance, democratic control, and member possession.

Gradually, credit rating unions have actually expanded in appeal worldwide due to their not-for-profit framework, concentrate on serving participants, and supplying competitive economic products and solutions. Today, cooperative credit union play a crucial function in the economic sector, giving accessible and community-oriented financial options for companies and people alike.

Subscription and Eligibility Standards

Membership at a credit history union is normally restricted to individuals satisfying specific eligibility criteria based on the institution's beginning concepts and regulatory needs. Some debt unions may just serve people who live or work in a specific location, while others may be customized to workers of a certain company or members of a specific organization.

Additionally, cooperative credit union are structured as not-for-profit organizations, meaning that their key objective is to offer their members rather than produce earnings for shareholders. This concentrate on participant service often translates right into even more individualized attention, reduced charges, and affordable rate of interest on savings and financings accounts. By meeting the eligibility criteria and ending up being a participant of a cooperative credit union, individuals can access a variety of financial product or services tailored to their details demands.

Solutions and Products Used

One of the key elements that sets cooperative credit union apart is the varied variety of economic product and services they use to their participants. Lending institution commonly give typical financial solutions such as savings and inspecting accounts, lendings, and bank card. Participants can additionally gain from investment services, consisting of pension and economic preparation aid. Several lending institution use competitive rates of interest on interest-bearing accounts and lendings, as well as lower fees contrasted to traditional banks.

Moreover, lending institution frequently supply hassle-free here are the findings online and mobile financial options for members to conveniently handle their finances. They may provide advantages such as common branching, permitting members to access their accounts at various other lending institution throughout the country. Some cooperative credit union additionally offer insurance policy products like life, home, and auto insurance to assist members protect their possessions and loved ones.

Advantages of Financial With Credit History Unions

When thinking about financial organizations, exploring the benefits of banking with credit unions discloses unique benefits for participants looking for individualized service and affordable rates. Unlike huge financial institutions, credit history unions are member-owned and focus on building strong connections with their participants. On the whole, financial with a credit history union can provide a much more tailored, economical, and member-centric economic experience.

Verdict

Finally, lending institution stick out as member-owned banks that prioritize serving their members over maximizing earnings. With beginnings going back to 19th century Europe, credit report unions adhere to concepts of continue reading this mutual help and member ownership. Click Here They offer a variety of monetary product and services, consisting of conventional financial services, financial investment alternatives, and competitive rates of interest. Subscription qualification criteria are certain and show a community-oriented approach, giving customized customer solution and a member-centric economic experience.

Credit score unions are member-owned financial institutions that use a range of financial solutions to their members. The principle of credit rating unions stem in the 19th century in Europe, with Friedrich Wilhelm Raiffeisen typically attributed as the leader of the cooperative financial motion.The evolution of credit report unions continued in North America, where Alphonse Desjardins developed the very first debt union in copyright in 1900. Credit rating unions normally supply typical financial solutions such as cost savings and inspecting accounts, finances, and credit cards.When taking into consideration monetary organizations, checking out the advantages of financial with credit history unions exposes unique benefits for participants looking for customized solution and competitive rates.

Report this page